Blog

Six misconceptions about fiat onramp aggregators

Separating fact from fiction can be tough in such a fast-moving industry. Find out why the top concerns about aggregators are actually wrong.

Fiat-to-crypto onramp aggregators are gaining traction as the go-to solution for platforms that want to reduce integration time and provide a more seamless onboarding experience for their customers.

As they grow in popularity, however, so do the myths surrounding their performance, pricing and general effectiveness.

In this article, we’ll debunk the most common ones we’ve seen.

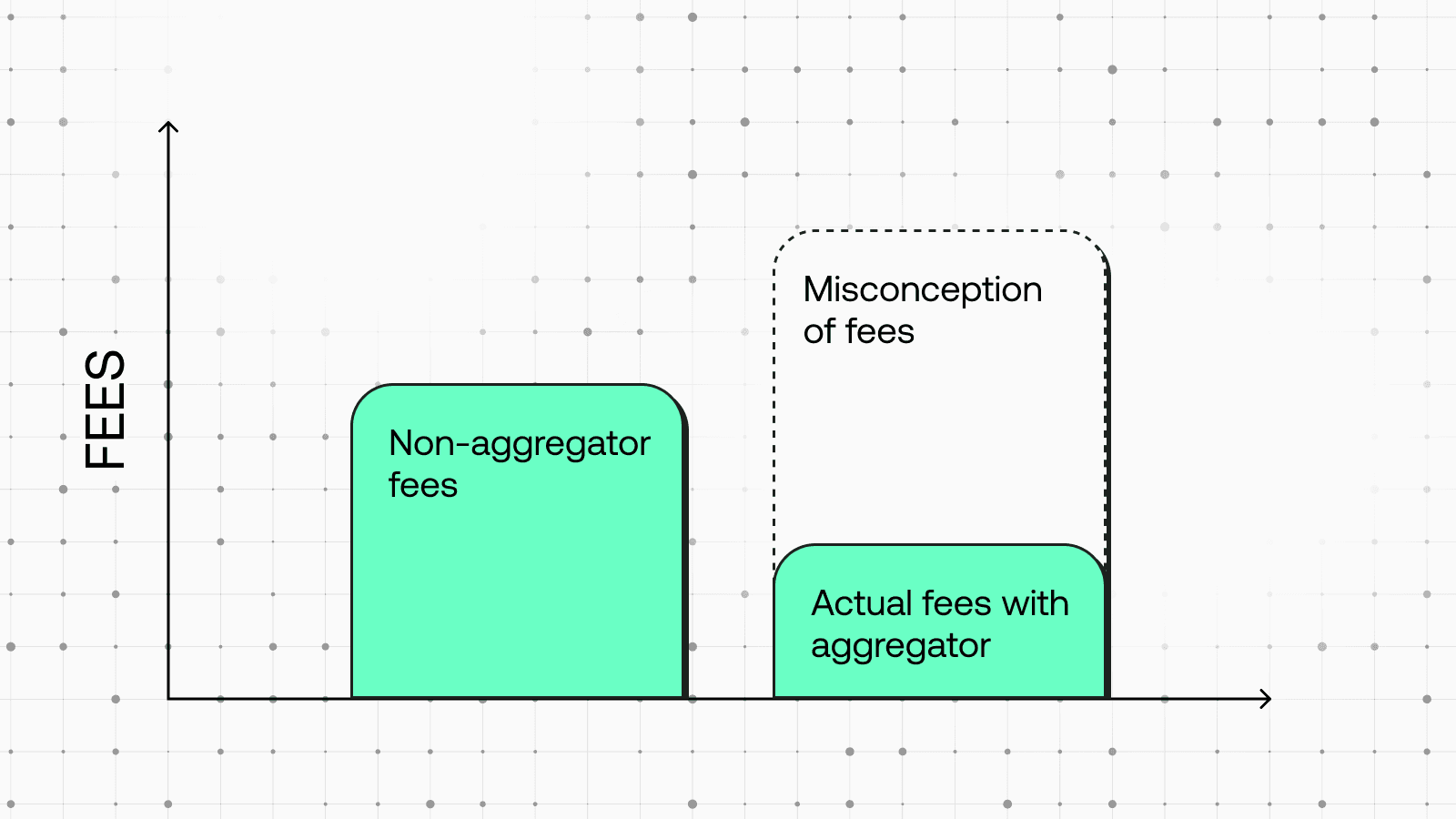

1. Aggregators result in higher fees for end users

By definition, this is false.

When using a single onramp, platforms lock their customers into restrictive fee regimes – where they’re at the mercy of whatever conversion rates, network fees and other costs the onramp chooses to leverage. The ‘fixed fee’ quoted by your onramp provider doesn’t account for these.

An aggregator, on the other hand, gives your customers much more flexibility. Based on their payment method, fiat currency and desired crypto, it can calculate (in real time) which onramp is most competitive on fees.

What’s more, an aggregator can typically negotiate lower rates than a single platform ever could: as Onramper generates high volumes and a good negotiating position with partners, we can ensure that no fees are added on top of the onramp’s.

In short: aggregation almost always secures lower fees for your customers.

2. Aggregators create compliance and security risk

What if one of the aggregator’s supported onramps suffers a security breach or fails to meet an acceptable level of regulatory compliance?

This is a valid concern. Inevitably, some onramps will be less secure and less compliant than others. In a worst-case scenario, you could be facilitating a transaction for bad actors via your platform.

But this isn’t an aggregator problem: it’s an onramp one. And a competent aggregator won’t add onramps without performing extensive due diligence beforehand — just as you wouldn’t. Even then, most integrations will allow you to enable/disable onramps based on your own risk model.

In the event of an unforeseeable security breach, onramp failure, or onramp default, an aggregator is actually beneficial: it won’t leave you stuck with a broken onboarding solution. At any given moment, your customers have several fallback options ready to go.

3. Aggregators are more difficult to integrate

Incredibly wrong. However, it’s something we’ve heard before, so it’s worth addressing.

One of the strongest value propositions for aggregators is their ease of integration. Instead of integrating, maintaining and juggling several onramps, businesses like yours can free up massive amounts of time and resources with a single solution.

Setup time varies. But, with Onramper, you can harness the power of a vast ecosystem of onramps with just eight lines of code (yes, really). If that’s not easy enough, you can rest assured that you’ll never need to troubleshoot or maintain onramps again — we handle all of that so you can focus on what you do best.

4. Aggregators offer an inferior user experience than an onramp

Not necessarily. At its core, an aggregator is a matching engine that automatically points your customers towards the correct onramp.

Since it usually taps into onramps’ APIs, an aggregator rarely requires the user to take a different course of action than if they were buying via a regular onramping widget.

At worst, some performance friction could arise if the matching engine was slow. But that’s not an issue for the top aggregators. Our own dynamic transaction routing system crunches over 70 factors to near-instantly connect customers with their perfect onramp.

On the surface, this process is so seamless that you’d be forgiven for thinking it was a regular, single onramping widget.

If anything, Onramper’s aggregator actually improves the user experience: low-KYC routing offers up the solution with minimal KYC required, and returning-user routing directs users to onramps they’ve previously used successfully.

5. Aggregators lack transparency

It may be true for some, but not for all. And certainly not for Onramper.

In fact, on the fee front, our stack is far more transparent than a single onramp’s. Instead of selecting a route based on quotes provided by onramps, we select it based on the amount of crypto received. In short, this ensures that users always get the best bang for their buck — without getting stung by the hidden costs that single onramps usually incur.

As for general transparency around onramping data? We make sure our customers have unmatched oversight, across the entire ecosystem, of how well each onramp is performing (thanks to the Onramper Terminal).

6. Aggregators don't work if you already have an onramping partner

Again, it may be true for some. But, personally, we love it when our customers come to us with established relationships. In fact, we’ve optimized the platform for it.

With Onramper, you can directly import your existing API keys. Via the Onramper Terminal, you can even compare their rates against ones from your new suite of onramps — ensuring that, no matter what, your users will always get the best rates.

Making the switch from a single onramp to an aggregator can be daunting. But it doesn't have to be. In just eight lines of code, you can integrate Onramper to immediately start boosting your success rates. Here's how.

Other articles

Onramper Integrates Ramp Network to Expand Global Crypto Payment Options

Onramper, the leading fiat-to-crypto onramp aggregator, has integrated Ramp Network, expanding its network of onramps and improving how users worldwide buy and sell digital assets.

Onramper, the leading fiat-to-crypto onramp aggregator, has integrated Ramp Network, expanding its network of onramps and improving how users worldwide buy and sell digital assets.

Through this partnership, Onramper clients instantly gain access to Ramp Network’s fast, compliant, and high-conversion payment flows without any additional development work. Businesses using Onramper can now offer lightning-fast purchases across major payment methods, including cards, Apple Pay, Google Pay, Revolut Pay, Pix, and instant bank transfers, all through a single API.

The collaboration also unlocks additional token listing opportunities for Onramper’s token listing support, providing even more flexibility and coverage for partners and their users.

The rollout of Ramp Network within the Onramper ecosystem will begin soon on a client-by-client basis. Existing Onramper partners will automatically gain access to Ramp Network without needing to make any changes to their setup.

“Ramp Network’s focus on speed, compliance, and user experience makes them a perfect addition to our network,” said Thijs Maas, CEO of Onramper. “This partnership gives our clients even more ways to connect users to crypto.”

“We’re aligned with Onramper in our mission to remove barriers to Web3 access,” said Przemek Kowalczyk, CEO and Co-Founder of Ramp Network. “This collaboration is a win for users, businesses, and the broader crypto ecosystem, offering faster, safer, and more flexible payment flows worldwide.”

The partnership strengthens Onramper’s aggregated network, enhancing coverage, conversion, and payment diversity through a single, unified connection.

To learn more, visit onramper.com and rampnetwork.com

About Onramper

Onramper is the leading fiat-to-crypto payments aggregator, providing a turnkey API-based solution for dynamically routing fiat-to-crypto onramp flows based on algorithms optimizing for conversion, fees and payment methods. Onramper’s platform allows users of clients to buy 2000+ digital assets, in over 190 countries with over 130 payment methods in 120 currencies, with advanced routing options and unified analytics. The company is based in the Netherlands. To learn more about Onramper, visit www.onramper.com.

About Ramp Network

Ramp Network is a global onramp and offramp provider offering secure, compliant, and user-friendly fiat-to-crypto payment solutions. With support for 110+ tokens across more than 40 blockchains, Ramp Network enables users to buy, sell, and swap crypto instantly using cards, Apple Pay, Google Pay, bank transfers, Revolut Pay, Pix, and other local methods.Its intuitive design and one-tap checkout experience make crypto purchases fast and frictionless, while strong regulatory compliance ensures safety and trust for users around the world.

Wello Joins Onramper’s Network to Expand Crypto Onboarding in Nigeria

Collaboration strengthens Onramper’s Nigerian payment rails for all partners

December 19, 2025 – Onramper, the world’s leading fiat-to-crypto onramp aggregator, announced that it has integrated Wello, a global fiat on- and off-ramp provider, to increase crypto accessibility in Nigeria. By integrating with Onramper, Wello’s localized payment rails will reach a wider audience, beginning with Nigeria and expanding across Asia. This partnership is part of the broader plan to bring stablecoin-powered payments to local markets around the world.

Nigeria remains one of the most active crypto markets globally, but ensuring reliable and high-performing fiat-to-crypto rails in the country remains a challenge. By incorporating Wello’s localized infrastructure, Onramper strengthens its presence in the region and delivers smoother, more successful conversion paths for every partner operating in Nigeria.

“Wello will strengthen the global coverage of our aggregation engine,” said Thijs Maas, CEO of Onramper. “Its dependable and deeply localized infrastructure gives our partners, and their users, the onboarding experience they expect, in Africa and beyond.”

Wello brings strong regional expertise across Africa and the Middle East, with payment rails designed for fast-growing, high-adoption crypto markets. Its localized approach reduces failed transactions and improves uptime for Nigerian users.

Onramper continues to lead the onramp aggregation space, connecting more than 30 global fiat gateways and supporting over 2,000 digital assets. All partners integrated with Onramper will automatically gain access to Wello’s rails, unlocking improved payment methods, stronger reliability, and broader coverage in Nigeria without requiring any technical changes.

“Our goal is to build dependable stablecoin payment rails for users around the world,” said Helen Hai, Co-Founder at Wello. “Partnering with Onramper makes our infrastructure available to more wallets, exchanges, and platforms, unlocking a smoother, more efficient onboarding experience.”

Onramper’s global network supports more than 130 payment methods across 190+ countries. Its smart routing engine recommends the best available conversion in real time, maximizing the likelihood of a successful transaction and helping users receive the most crypto for their fiat.

To learn more, please visit onramper.com and wello.tech.

About Onramper

Onramper is the leading fiat-to-crypto payments aggregator, providing a turnkey API-based solution for dynamically routing fiat-to-crypto onramp flows based on algorithms optimizing for conversion, fees and payment methods. Onramper’s platform allows users of clients to buy 2000+ digital assets, in over 190 countries with over 170 payment methods in 120 currencies, with advanced routing options and unified analytics. The company is based in the Netherlands. To learn more about Onramper, visit www.onramper.com.

About Wello

Wello brings real utility to stablecoins. With compliant fiat on/off ramps, instant QR payments, and cross-border settlement. Wello’s mission is to bridge Web3 with real-world payments, empowering people to send global, spend local, effortlessly.

HaHa Wallet Partners with Onramper to Expand Access to the Monad Ecosystem

Partnership follows Monad Mainnet launch to unlock global onboarding

AMSTERDAM, Dec. 17, 2025 — Onramper, the world’s leading fiat-to-crypto onramp aggregator, today announced a strategic partnership with HaHa Wallet, next-generation, Monad-native crypto wallet, to broaden global accessibility for users engaging with Monad ecosystem.

Through the integration, HaHa Wallet users can now buy crypto using over 130 local payment methods across 190+ countries, benefiting from competitive rates and optimized fees. Following the launch of Monad’s public Mainnet in November 2025, the partnership makes it easier for users worldwide to enter Monad and begin trading, bridging, and exploring dApps.

HaHa Wallet has quickly become a leading gateway into Monad, offering a fast, intuitive, and reward-driven user experience. With Onramper’s global payments coverage and smart routing engine, users can move from fiat to crypto in just a few clicks and start interacting onchain.

“Realizing Monad’s full potential depends on frictionless onboarding,” said Thijs Maas, CEO of Onramper. “Our partnership with HaHa Wallet brings trusted, localized payment access directly into the Monad ecosystem. Together, we’re making it easier than ever for people everywhere to get started on Monad.”

Monad’s unique architecture enables parallel transaction execution, delivering faster speeds, quicker finality, and lower fees without sacrificing decentralization. Combined with Onramper’s global payment infrastructure, HaHa Wallet provides users with a streamlined entry point into Monad’s high-performance blockchain environment.

“Our focus is building the simplest possible entry point into the Monad Ecosystem,” said Mu Li, founder of HaHa Wallet. “Integrating Onramper allows us to offer trusted local payment methods, helping users get onchain quickly and confidently, no matter where they are in the world.”

Onramper continues to lead the onramp aggregation space, connecting more than 30 global fiat gateways and supporting over 2,000 digital assets, driving greater accessibility and inclusivity across Web3.

To learn more, please visit onramper.com and haha.me

About Onramper

Onramper is the leading fiat-to-crypto payments aggregator, providing a turnkey API-based solution for dynamically routing fiat-to-crypto onramp flows based on algorithms optimizing for conversion, fees and payment methods. Onramper’s platform allows users of clients to buy 2000+ digital assets, in over 190 countries with over 130 payment methods in 120 currencies, with advanced routing options and unified analytics. The company is based in the Netherlands. To learn more about Onramper, visit www.onramper.com.

About HaHa Wallet

HaHa Wallet is the Monad native, high performance smart wallet built to maximise how users earn and participate on chain. Purpose built for Monad’s low latency, parallel execution environment, HaHa delivers lightning fast swaps, deep native integrations with Monad dApps and ecosystem campaigns, and seamless access to multiple EVM chains through a single non custodial experience. Users earn Karma for meaningful on chain activity, unlocking rewards, ecosystem access, and future HaHa token utility, positioning HaHa Wallet as the primary consumer gateway to Monad and a rewards driven hub for Web3 participation.

For media enquiries, contact: